How to do bas statement.

If you’re looking for how to do bas statement pictures information connected with to the how to do bas statement interest, you have come to the right blog. Our site always provides you with suggestions for seeking the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

How To Complete A Business Activity Statement With Pictures From wikihow.com

How To Complete A Business Activity Statement With Pictures From wikihow.com

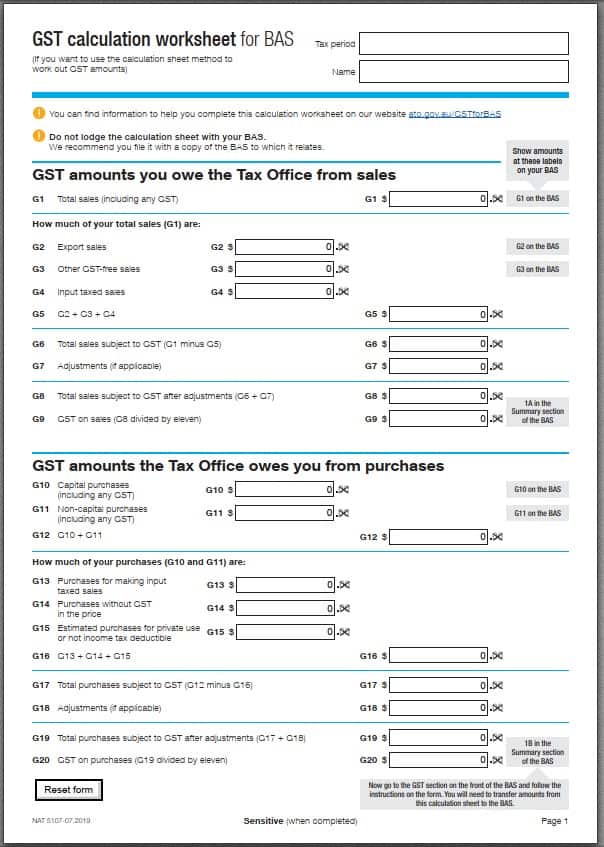

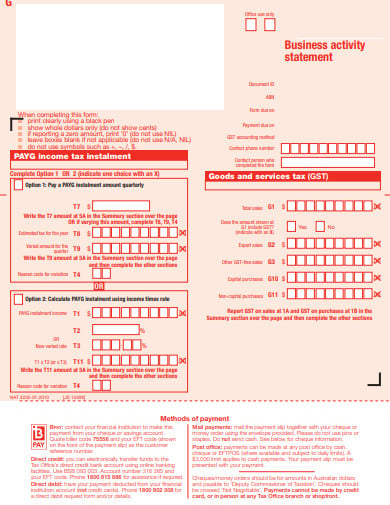

Fill in the summary section. Online through the Business Portal or Standard Business Reporting SBR software. 2 What Is a Business Activity Statement BAS. The amounts you report on your BAS at G1 total sales can be GST-inclusive or GST-exclusive.

Online through the Business Portal or Standard Business Reporting SBR software.

MYOB Essentials BAS preparation Online Learning with Applied Education. Organise All Your Business Activity Information. 4 PAYG Withholding on Your BAS Statement. Via your online accounting software. By having a registered tax or BAS agent generally an accountant or bookkeeper submit it for you.

Source: pdfprof.com

Source: pdfprof.com

You can lodge your BAS. Through your myGov account if youre a sole trader. 2 What Is a Business Activity Statement BAS. One of the most common questions we receive here at Sage Business Group is How do I read my Business Activity Statement BAS Here Co-Director Tim McCart. When you use our online services youll get reminder messages as you complete your BAS to help you get it right and avoid errors.

Enter whole dollar amounts leave cents out and dont round up to the next dollar enter each invoice once only if you account for GST on a cash basis your expenses and sales must fall within the period you made or received payment.

This will give you certainty of your position with us and shows youre aware of your obligations and doing your best to. Fill in the summary section. You will find the summary section on the back of your BAS. With quarterly business activity statements BAS due 28 July and the Business Portal decomissioning at the end of July now is the time to start lodging your BAS using Online services for business.

Source: pdfprof.com

Source: pdfprof.com

Top 3 takeaways A Business Activity Statement BAS summarises the tax that your business has paid. One of the most common questions we receive here at Sage Business Group is How do I read my Business Activity Statement BAS Here Co-Director Tim McCart. You have several options for lodging your business activity statements BAS and reporting your goods and services tax GST pay as you go PAYG instalments PAYG withholding tax and other taxes to us. Match to existing or create new transactions for all statement lines in all bank accounts Ensure that your Statement Balance is the same as your Balance in Xero for each bank account Check your statement balance for each bank account against the balances in Xero Account for all non-bank transactions affecting the BAS.

Source: popbusiness.com.au

Source: popbusiness.com.au

You have several options for lodging your business activity statements BAS and reporting your goods and services tax GST pay as you go PAYG instalments PAYG withholding tax and other taxes to us. How do I do a BAS statement. By having a registered tax or BAS agent generally an accountant or bookkeeper submit it for you. With quarterly business activity statements BAS due 28 July and the Business Portal decomissioning at the end of July now is the time to start lodging your BAS using Online services for business.

Source: in.pinterest.com

Source: in.pinterest.com

You will find the summary section on the back of your BAS. By having a registered tax or BAS agent generally an accountant or bookkeeper submit it for you. Organise All Your Business Activity Information. The amounts you report on your BAS at G1 total sales can be GST-inclusive or GST-exclusive.

By having a registered tax or BAS agent generally an accountant or bookkeeper submit it for you. When you register for an Australian business number ABN and GST we will automatically send you a BAS. The Australian Taxation Office ATO will send your activity statement about 2 weeks before the end of your reporting period. Fill in the summary section.

Through your myGov account if youre a sole trader.

When you register for an Australian business number ABN and GST we will automatically send you a BAS. Even if you cant pay by the due date you still need to lodge your BAS on time. When you register for an Australian business number ABN and GST we will automatically send you a BAS. The amounts you report on your BAS at G1 total sales can be GST-inclusive or GST-exclusive. Details on our website -.

Source: wikihow.com

Source: wikihow.com

With quarterly business activity statements BAS due 28 July and the Business Portal decomissioning at the end of July now is the time to start lodging your BAS using Online services for business. Details on our website -. 5 Pay As You Go Instalments. When you register for an Australian business number ABN and GST we will automatically send you a BAS. You will find the summary section on the back of your BAS.

Fill in the summary section. Through the ATOs online business portal. 6 Step By Step Guide on How To Do a BAS Statement. You have several options for lodging your business activity statements BAS and reporting your goods and services tax GST pay as you go PAYG instalments PAYG withholding tax and other taxes to us.

How to lodge a BAS.

You need to indicate amounts that include GST by marking either Yes or No with an X in the box under G1. Through your myGov account if youre a sole trader. You have several options for lodging your business activity statements BAS and reporting your goods and services tax GST pay as you go PAYG instalments PAYG withholding tax and other taxes to us. Business activity statements BAS If you are a business registered for GST you need to lodge a business activity statement BAS.

Source: wikihow.com

Source: wikihow.com

6 Step By Step Guide on How To Do a BAS Statement. With quarterly business activity statements BAS due 28 July and the Business Portal decomissioning at the end of July now is the time to start lodging your BAS using Online services for business. Business activity statements BAS If you are a business registered for GST you need to lodge a business activity statement BAS. Fill in the summary section.

Source: wikihow.com

Source: wikihow.com

To keep on top of your BAS obligations remember to keep accurate records sort your accounts according to. Match to existing or create new transactions for all statement lines in all bank accounts Ensure that your Statement Balance is the same as your Balance in Xero for each bank account Check your statement balance for each bank account against the balances in Xero Account for all non-bank transactions affecting the BAS. Your BAS will help you report and pay your. Online through the Business Portal or Standard Business Reporting SBR software.

Source: wikihow.com

Source: wikihow.com

Organise All Your Business Activity Information. When completing your BAS. This will give you certainty of your position with us and shows youre aware of your obligations and doing your best to. With quarterly business activity statements BAS due 28 July and the Business Portal decomissioning at the end of July now is the time to start lodging your BAS using Online services for business.

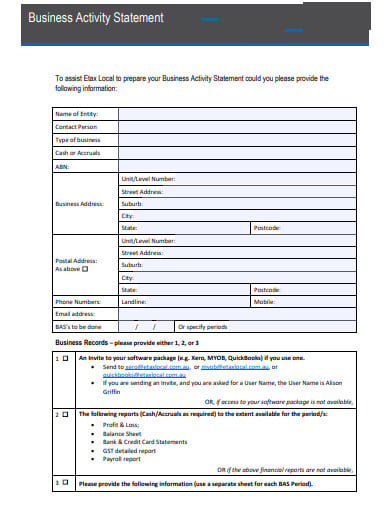

In this section youll report the total amount of GST you are liable to pay for the period covered by the.

Lodge your BAS online. Fill in the summary section. The Australian Taxation Office ATO will send your activity statement about 2 weeks before the end of your reporting period. Through a registered tax or BAS agent. Your BAS will help you report and pay your.

Source: pdfprof.com

Source: pdfprof.com

Match to existing or create new transactions for all statement lines in all bank accounts Ensure that your Statement Balance is the same as your Balance in Xero for each bank account Check your statement balance for each bank account against the balances in Xero Account for all non-bank transactions affecting the BAS. Top 3 takeaways A Business Activity Statement BAS summarises the tax that your business has paid. You need to indicate amounts that include GST by marking either Yes or No with an X in the box under G1. You have several options for lodging your business activity statements BAS and reporting your goods and services tax GST pay as you go PAYG instalments PAYG withholding tax and other taxes to us. In this section youll report the total amount of GST you are liable to pay for the period covered by the.

Organise All Your Business Activity Information.

By having a registered tax or BAS agent generally an accountant or bookkeeper submit it for you. How do I do a BAS statement. Match to existing or create new transactions for all statement lines in all bank accounts Ensure that your Statement Balance is the same as your Balance in Xero for each bank account Check your statement balance for each bank account against the balances in Xero Account for all non-bank transactions affecting the BAS. Your BAS will help you report and pay your.

Source: pdfprof.com

Source: pdfprof.com

Online through the Business Portal or Standard Business Reporting SBR software. 6 Step By Step Guide on How To Do a BAS Statement. Your BAS will help you report and pay your. Even if you cant pay by the due date you still need to lodge your BAS on time.

Source: pdfprof.com

Source: pdfprof.com

Match to existing or create new transactions for all statement lines in all bank accounts Ensure that your Statement Balance is the same as your Balance in Xero for each bank account Check your statement balance for each bank account against the balances in Xero Account for all non-bank transactions affecting the BAS. You have several options for lodging your business activity statements BAS and reporting your goods and services tax GST pay as you go PAYG instalments PAYG withholding tax and other taxes to us. Online through the Business Portal or Standard Business Reporting SBR software. Complete and return by the due date on your BAS along with any payment due.

Source: atotaxrates.info

Source: atotaxrates.info

Through a registered tax or BAS agent. BAS GST guide - POP Business. You can lodge your BAS. Enter whole dollar amounts leave cents out and dont round up to the next dollar enter each invoice once only if you account for GST on a cash basis your expenses and sales must fall within the period you made or received payment.

By having a registered tax or BAS agent generally an accountant or bookkeeper submit it for you.

With quarterly business activity statements BAS due 28 July and the Business Portal decomissioning at the end of July now is the time to start lodging your BAS using Online services for business. Your BAS will help you report and pay your. You have several options for lodging your business activity statements BAS and reporting your goods and services tax GST pay as you go PAYG instalments PAYG withholding tax and other taxes to us. 6 Step By Step Guide on How To Do a BAS Statement. Through the ATOs online business portal.

Source: wikihow.com

Source: wikihow.com

Complete and return by the due date on your BAS along with any payment due. Complete and return by the due date on your BAS along with any payment due. By having a registered tax or BAS agent generally an accountant or bookkeeper submit it for you. Fill in the summary section. Organise All Your Business Activity Information.

In this section youll report the total amount of GST you are liable to pay for the period covered by the.

How do I do a BAS statement. How do I do a BAS statement. The amounts you report on your BAS at G1 total sales can be GST-inclusive or GST-exclusive. Top 3 takeaways A Business Activity Statement BAS summarises the tax that your business has paid.

Source: popbusiness.com.au

Source: popbusiness.com.au

Enter whole dollar amounts leave cents out and dont round up to the next dollar enter each invoice once only if you account for GST on a cash basis your expenses and sales must fall within the period you made or received payment. Your BAS will help you report and pay your. 2 What Is a Business Activity Statement BAS. Online through the Business Portal or Standard Business Reporting SBR software. To keep on top of your BAS obligations remember to keep accurate records sort your accounts according to.

Source: template.net

Source: template.net

When you register for an Australian business number ABN and GST we will automatically send you a BAS. You need to indicate amounts that include GST by marking either Yes or No with an X in the box under G1. 4 PAYG Withholding on Your BAS Statement. This will give you certainty of your position with us and shows youre aware of your obligations and doing your best to. Enter whole dollar amounts leave cents out and dont round up to the next dollar enter each invoice once only if you account for GST on a cash basis your expenses and sales must fall within the period you made or received payment.

Source: wikihow.com

Source: wikihow.com

Organise All Your Business Activity Information. BAS GST guide - POP Business. You will find the summary section on the back of your BAS. The amounts you report on your BAS at G1 total sales can be GST-inclusive or GST-exclusive. Online through the Business Portal or Standard Business Reporting SBR software.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how to do bas statement by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.