How to claim australian tax back.

If you’re looking for how to claim australian tax back images information related to the how to claim australian tax back keyword, you have visit the ideal blog. Our website frequently provides you with hints for refferencing the maximum quality video and image content, please kindly search and find more informative video articles and graphics that fit your interests.

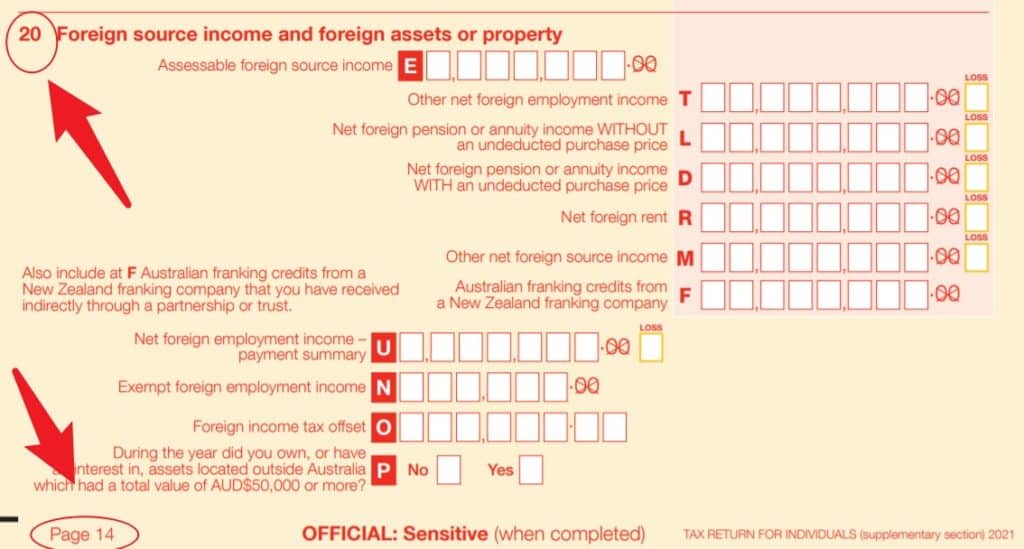

Foreign Income Tax Offset 2021 Atotaxrates Info From atotaxrates.info

Foreign Income Tax Offset 2021 Atotaxrates Info From atotaxrates.info

Use this service to see how to claim if you paid too much on. You can apply for your Australian tax refund at end of the tax year or one month before you leave the country. Ad Claim Back Your Uniform Expenses Today - Complete Our Quick Easy Form In Under 2 Minutes. To apply for Australian tax back you must have your final pay slip or PAYG in order.

When you lodge a tax return you include how much money you earn income and any expenses you can claim as a deduction.

Do I need a Tax File Number. Over 50m Claimed For More Than 40000 Tax Payers - Make Your Claim Now. The tax year in Oz runs from July 1st to June 30th. 1 in 3 People Are Owed A Tax Rebate With The Average Claim Worth 3000. Ad Complete our 2 minute application form and get a refund for your overpaid tax.

Source: 7news.com.au

Source: 7news.com.au

Ad Answer A Few Simple Questions And Our Experts Will Take Care Of Everything. Claim a tax refund You may be able to get a tax refund rebate if youve paid too much tax. Easy fast and secure online process. Ad Answer A Few Simple Questions And Our Experts Will Take Care Of Everything. Ad Worked in Australia on a visa.

Your TFN Tax File Number is a unique number issued by the Australian Taxation Office and anyone planning to work in Australia needs to get one.

Ad Answer A Few Simple Questions And Our Experts Will Take Care Of Everything. If you need to complete a tax return you must lodge it or engage with a tax agent by 31 October. Over 50m Claimed For More Than 40000 Tax Payers - Make Your Claim Now. Your tax return covers the income year from 1 July to 30 June.

Source: ato.gov.au

Source: ato.gov.au

Ad Answer A Few Simple Questions And Our Experts Will Take Care Of Everything. When you return home after working in Australia you need to lodge a tax return in order to claim back tax. The same applies for a working holiday visa. You can apply for your Australian tax refund at end of the tax year or one month before you leave the country.

Source: australia-backpackersguide.com

Source: australia-backpackersguide.com

Ad Complete our 2 minute application form and get a refund for your overpaid tax. Ad Claim Back Your Uniform Expenses Today - Complete Our Quick Easy Form In Under 2 Minutes. If you need to complete a tax return you must lodge it or engage with a tax agent by 31 October. Alcohol and tobacco products.

Source: 7news.com.au

Source: 7news.com.au

Over 50m Claimed For More Than 40000 Tax Payers - Make Your Claim Now. Your TFN Tax File Number is a unique number issued by the Australian Taxation Office and anyone planning to work in Australia needs to get one. The same applies for a working holiday visa. This means you would be unable to claim back on the tax you incurred as a foreign resident.

You can lodge online using myTax through a registered tax agent or complete a paper tax return. Your TFN Tax File Number is a unique number issued by the Australian Taxation Office and anyone planning to work in Australia needs to get one. When you lodge a tax return you include how much money you earn income and any expenses you can claim as a deduction. Claiming Back Tax from Australia.

Your tax return covers the income year from 1 July to 30 June.

Ad Answer A Few Simple Questions And Our Experts Will Take Care Of Everything. The average tax refund our customers get is 2600. You can apply for your Australian tax refund at end of the tax year or one month before you leave the country. The form includes a schedule for general purchases which needs to be completed. Use this service to see how to claim if you paid too much on.

Source: hillyerriches.com.au

Source: hillyerriches.com.au

If it was permanent you must lodge a paper return whilst you are still in Australia before your scheduled departure. Use this form to claim a refund of the GST and any WET you paid on the purchase of. We can get your tax back. Alcohol and tobacco products. You can apply for your Australian tax refund at end of the tax year or one month before you leave the country.

Ad Complete our 2 minute application form and get a refund for your overpaid tax. Over 50m Claimed For More Than 40000 Tax Payers - Make Your Claim Now. You can lodge online using myTax through a registered tax agent or complete a paper tax return. We can get your tax back.

Pay from your current or previous job.

This means you would be unable to claim back on the tax you incurred as a foreign resident. Ad Complete our 2 minute application form and get a refund for your overpaid tax. If it was permanent you must lodge a paper return whilst you are still in Australia before your scheduled departure. If you need to complete a tax return you must lodge it or engage with a tax agent by 31 October.

Source: movingtoaustralia.co.nz

Source: movingtoaustralia.co.nz

Find updated content daily for claim tax back. Australian Tax File Number. However if you were subject to emergency tax at any point during your time in Australia you are entitled to claim that back regardless of your visa or the length of your stay. The same applies for a working holiday visa.

Source: ato.gov.au

Source: ato.gov.au

When you lodge a tax return you include how much money you earn income and any expenses you can claim as a deduction. If you need to complete a tax return you must lodge it or engage with a tax agent by 31 October. Ad This is the newest place to search delivering top results from across the web. Claim a tax refund You may be able to get a tax refund rebate if youve paid too much tax.

Source: 7news.com.au

Source: 7news.com.au

If it was permanent you must lodge a paper return whilst you are still in Australia before your scheduled departure. We can get your tax back. However if you were subject to emergency tax at any point during your time in Australia you are entitled to claim that back regardless of your visa or the length of your stay. Ad Answer A Few Simple Questions And Our Experts Will Take Care Of Everything.

Your TFN Tax File Number is a unique number issued by the Australian Taxation Office and anyone planning to work in Australia needs to get one.

Ad Answer A Few Simple Questions And Our Experts Will Take Care Of Everything. Ad Answer A Few Simple Questions And Our Experts Will Take Care Of Everything. This will make the entire process easier on your part and you wont need to spend extra time and energy to track it down. When you lodge a tax return you include how much money you earn income and any expenses you can claim as a deduction. The form includes a schedule for general purchases which needs to be completed.

Source: movingtoaustralia.co.nz

Source: movingtoaustralia.co.nz

Find updated content daily for claim tax back. Ad This is the newest place to search delivering top results from across the web. Over 50m Claimed For More Than 40000 Tax Payers - Make Your Claim Now. If it was permanent you must lodge a paper return whilst you are still in Australia before your scheduled departure. Find updated content daily for claim tax back.

1 in 3 People Are Owed A Tax Rebate With The Average Claim Worth 3000.

Use this service to see how to claim if you paid too much on. Dont Overpay your Taxes Claim Back Today. Ad Answer A Few Simple Questions And Our Experts Will Take Care Of Everything. Complete an Application for refund under Indirect Tax Concession ITCS Scheme - General claim.

Source: hillyerriches.com.au

Source: hillyerriches.com.au

Ad This is the newest place to search delivering top results from across the web. You can apply for your Australian tax refund at end of the tax year or one month before you leave the country. Ad Complete our 2 minute application form and get a refund for your overpaid tax. However if you were subject to emergency tax at any point during your time in Australia you are entitled to claim that back regardless of your visa or the length of your stay.

Source: australia-backpackersguide.com

Source: australia-backpackersguide.com

To apply for Australian tax back you must have your final pay slip or PAYG in order. Claim your tax refund here. Ad Worked in Australia on a visa. Over 50m Claimed For More Than 40000 Tax Payers - Make Your Claim Now.

Source: tr.pinterest.com

Source: tr.pinterest.com

The same applies for a working holiday visa. Ad Complete our 2 minute application form and get a refund for your overpaid tax. The same applies for a working holiday visa. Ad Answer A Few Simple Questions And Our Experts Will Take Care Of Everything.

Use this form to claim a refund of the GST and any WET you paid on the purchase of.

When you return home after working in Australia you need to lodge a tax return in order to claim back tax. Claim a tax refund You may be able to get a tax refund rebate if youve paid too much tax. Easy fast and secure online process. This means you would be unable to claim back on the tax you incurred as a foreign resident. Ad Complete our 2 minute application form and get a refund for your overpaid tax.

Source: hillyerriches.com.au

Source: hillyerriches.com.au

Your tax return covers the income year from 1 July to 30 June. This means you would be unable to claim back on the tax you incurred as a foreign resident. Claim a tax refund You may be able to get a tax refund rebate if youve paid too much tax. Alcohol and tobacco products. 1 in 3 People Are Owed A Tax Rebate With The Average Claim Worth 3000.

Ad Worked in Australia on a visa.

Pay from your current or previous job. Claim your tax refund here. You can apply for your Australian tax refund at end of the tax year or one month before you leave the country. To apply for Australian tax back you must have your final pay slip or PAYG in order.

Source: tr.pinterest.com

Source: tr.pinterest.com

1 in 3 People Are Owed A Tax Rebate With The Average Claim Worth 3000. Ad Answer A Few Simple Questions And Our Experts Will Take Care Of Everything. When you lodge a tax return you include how much money you earn income and any expenses you can claim as a deduction. Dont Overpay your Taxes Claim Back Today. Alcohol and tobacco products.

Your tax return covers the income year from 1 July to 30 June. When you return home after working in Australia you need to lodge a tax return in order to claim back tax. Claim your tax refund here. This will make the entire process easier on your part and you wont need to spend extra time and energy to track it down. Ad Worked in Australia on a visa.

Source: hillyerriches.com.au

Source: hillyerriches.com.au

If you need to complete a tax return you must lodge it or engage with a tax agent by 31 October. Over 50m Claimed For More Than 40000 Tax Payers - Make Your Claim Now. When you return home after working in Australia you need to lodge a tax return in order to claim back tax. Ad Answer A Few Simple Questions And Our Experts Will Take Care Of Everything. If you need to complete a tax return you must lodge it or engage with a tax agent by 31 October.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how to claim australian tax back by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.