How to calculate tax australia.

If you’re searching for how to calculate tax australia images information linked to the how to calculate tax australia topic, you have come to the right blog. Our site frequently provides you with hints for seeking the highest quality video and picture content, please kindly search and locate more enlightening video articles and graphics that match your interests.

Calculating Income Tax Payable Youtube From youtube.com

Calculating Income Tax Payable Youtube From youtube.com

ASIC Money Smart Tax On Shares. If the full value of your items and shipping is over the import tax on a shipment will be. Less any capital losses. Youll then get a breakdown of your total tax liability and take-home pay.

Simple steps to lodge your 2021 tax return online.

How to Calculate Income Tax in Australia 1. You could also use a simpler equation taken from the ATOs tax rate table above to calculate your income tax. Just select Non-Resident click Calculate and calculator will update calculations with non-resident tax rates. Sacrificing part of your salary can reduce your tax. The income tax calculator calculates the tax payable on gross wages paid in equal weekly amounts.

Source: educba.com

Source: educba.com

Now you can calculate your salary and your tax withholding if you a non-resident for tax purposes in Australia. It will take between 2 and 10 minutes to use this calculator. Instantly work out your estimated tax return refund. Simple steps to lodge your 2021 tax return online. For example if the retail price for a t-shirt stands at around 50 but GST hasnt been applied you can work out the GST-inclusive price like so.

Sacrificing part of your salary can reduce your tax.

In order for the recipient to receive a package an additional amount of. This link opens in a new window. Foreign income tax offset 200 Franking credit 300 Total tax payable. Calculate salary for non-residents NEW.

Source: pinterest.com

Source: pinterest.com

The income tax calculator calculates the tax payable on gross wages paid in equal weekly amounts. If the full value of your items and shipping is over the import tax on a shipment will be. Now you can calculate your salary and your tax withholding if you a non-resident for tax purposes in Australia. Simply enter your annual or monthly income into the tax calculator above to find out how Australian taxes affect your income.

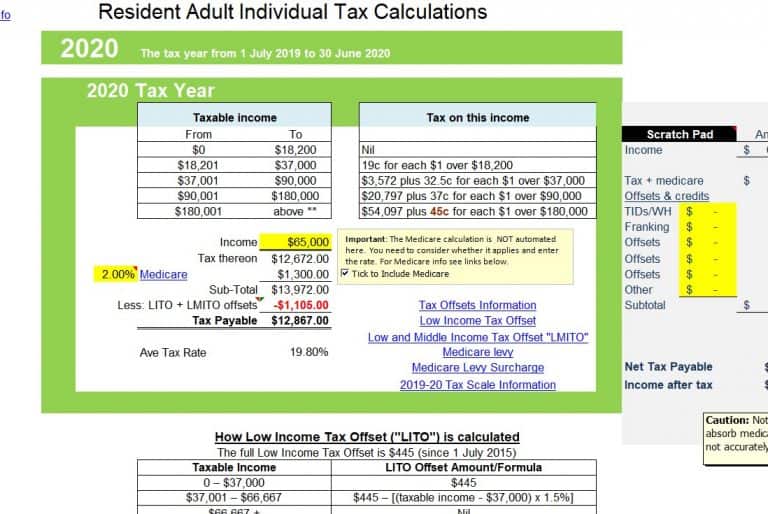

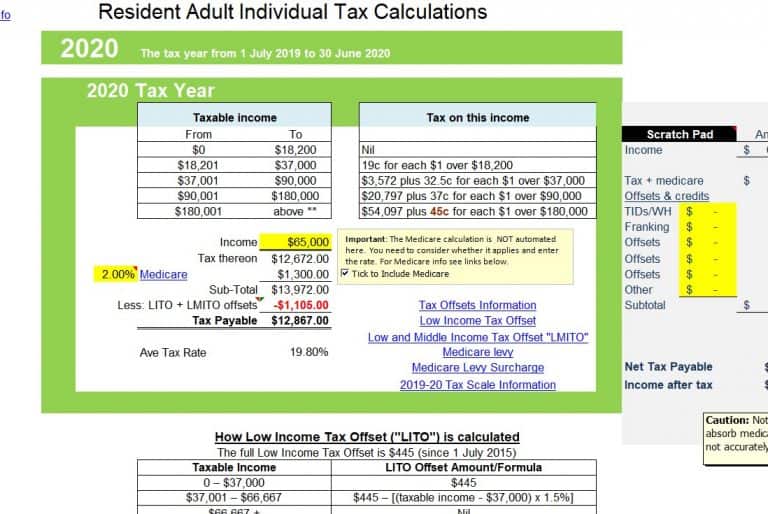

Source: atotaxrates.info

Source: atotaxrates.info

There is a capital gains tax CGT discount of 50 for Australian individuals who own an asset for 12 months or more. If the full value of your items and shipping is over the import tax on a shipment will be. There is a capital gains tax CGT discount of 50 for Australian individuals who own an asset for 12 months or more. ATO calculate your income tax rate by summing the total of all your sources of income including PAYGSalary jobs together with self-employed income investment income etc and then applying their standard tax rates.

Source: in.pinterest.com

Source: in.pinterest.com

Youll then get a breakdown of your total tax liability and take-home pay. This calculator will help you work out your tax refund or debt estimate. Simply enter your numbers and our tax calculator will do the maths for you. It can be used for the 201314 to 202021 income.

Then find out how you can slash your taxes. CALCULATE YOUR REFUND NOW. Up next in Income tax. The income tax rates for PAYG earners and.

Now you can calculate your salary and your tax withholding if you a non-resident for tax purposes in Australia.

You pay tax on your net capital gains. Sacrificing part of your salary can reduce your tax. Canstar has an income tax calculator that can assist you to calculate your approximate income tax for the current financial year. You could also use a simpler equation taken from the ATOs tax rate table above to calculate your income tax. If the full value of your items and shipping is over the import tax on a shipment will be.

Source: youtube.com

Source: youtube.com

Less any discount you are entitled to on your gains. Simply enter your numbers and our tax calculator will do the maths for you. How to Calculate Income Tax in Australia 1. Use the Simple tax calculator to work out the tax you owe on your taxable income for the full income year. This means you pay tax on only half the net capital gain on that asset.

Then find out how you can slash your taxes. Up next in Income tax. ATO calculate your income tax rate by summing the total of all your sources of income including PAYGSalary jobs together with self-employed income investment income etc and then applying their standard tax rates. If you sell or swap your cryptocurrency and make a profit you may need to pay tax on that profit as crypto profits are subject to capital gains tax CGT in Australia unless you are a professional.

If you sell or swap your cryptocurrency and make a profit you may need to pay tax on that profit as crypto profits are subject to capital gains tax CGT in Australia unless you are a professional.

Although its a simple calculation you dont need to use the GST formula if you dont want to. Crypto Tax Calculator Australia. Simply enter your numbers and our tax calculator will do the maths for you. Access the calculator.

Source: atotaxrates.info

Source: atotaxrates.info

You could also use a simpler equation taken from the ATOs tax rate table above to calculate your income tax. Simply enter your annual or monthly income into the tax calculator above to find out how Australian taxes affect your income. Then find out how you can slash your taxes. Calculate salary for non-residents NEW.

Source: atotaxrates.info

Source: atotaxrates.info

Use the free crypto tax calculator below to estimate how much CGT you may need to pay on your crypto asset sale. Lodging a tax return. How to Calculate Income Tax in Australia 1. Instantly work out your estimated tax return refund.

Source: pinterest.com

Source: pinterest.com

Calculate salary for non-residents NEW. If the full value of your items and shipping is over the import tax on a shipment will be. Simply enter your annual or monthly income into the tax calculator above to find out how Australian taxes affect your income. ASIC Money Smart Tax On Shares.

Find out if youll get a tax refund.

It will take between 2 and 10 minutes to use this calculator. The rates are obtained from the Australian Taxation Office. Crypto Tax Calculator Australia. Foreign income tax offset 200 Franking credit 300 Total tax payable. Preliminary questions Determine whether you are an Australian resident for tax purposes This is the first question.

Source: pinterest.com

Source: pinterest.com

For example if the declared value of your shipment is. 50 x 11 55. Canstar has an income tax calculator that can assist you to calculate your approximate income tax for the current financial year. Use the Simple tax calculator to work out the tax you owe on your taxable income for the full income year. Your total capital gains.

If the full value of your items and shipping is over the import tax on a shipment will be.

You could also use a simpler equation taken from the ATOs tax rate table above to calculate your income tax. Income tax estimator This link opens in a new window it will take between 15 and 25 minutes to use this calculator. The rates are obtained from the Australian Taxation Office. Sacrificing part of your salary can reduce your tax.

Source: educba.com

Source: educba.com

Medicare levy 134500 x 2 2690. The rates are obtained from the Australian Taxation Office. Use the Simple tax calculator to work out the tax you owe on your taxable income for the full income year. If you sell or swap your cryptocurrency and make a profit you may need to pay tax on that profit as crypto profits are subject to capital gains tax CGT in Australia unless you are a professional.

Source: atotaxrates.info

Source: atotaxrates.info

Up next in Income tax. Simply enter your annual or monthly income into the tax calculator above to find out how Australian taxes affect your income. Medicare levy 134500 x 2 2690. If the full value of your items and shipping is over the import tax on a shipment will be.

Source: pinterest.com

Source: pinterest.com

50 x 11 55. You could also use a simpler equation taken from the ATOs tax rate table above to calculate your income tax. 29467 037 x 5000 31317. This link opens in a new window.

It can be used for the 201314 to 202021 income.

ATO calculate your income tax rate by summing the total of all your sources of income including PAYGSalary jobs together with self-employed income investment income etc and then applying their standard tax rates. It will take between 2 and 10 minutes to use this calculator. Determine your assessable income Assessable income is income that can be taxed by the ATO. Use the Simple tax calculator to work out the tax you owe on your taxable income for the full income year. ASIC Money Smart Tax On Shares.

Source: in.pinterest.com

Source: in.pinterest.com

29467 037 x 5000 31317. If the full value of your items and shipping is over the import tax on a shipment will be. Your total capital gains. Lodging a tax return. ATO calculate your income tax rate by summing the total of all your sources of income including PAYGSalary jobs together with self-employed income investment income etc and then applying their standard tax rates.

Also known as Gross Income.

Use the free crypto tax calculator below to estimate how much CGT you may need to pay on your crypto asset sale. Medicare levy 134500 x 2 2690. If you sell or swap your cryptocurrency and make a profit you may need to pay tax on that profit as crypto profits are subject to capital gains tax CGT in Australia unless you are a professional. The rates are obtained from the Australian Taxation Office.

Source: educba.com

Source: educba.com

The Tax Free Threshold Is 1000 AUD. The income tax rates for PAYG earners and. For example for Joe it would be. In order for the recipient to receive a package an additional amount of. Salary Before Tax your total earnings before any taxes have been deducted.

Source: in.pinterest.com

Source: in.pinterest.com

Use the Simple tax calculator to work out the tax you owe on your taxable income for the full income year. If you sell or swap your cryptocurrency and make a profit you may need to pay tax on that profit as crypto profits are subject to capital gains tax CGT in Australia unless you are a professional. The income tax calculator calculates the tax payable on gross wages paid in equal weekly amounts. This means you pay tax on only half the net capital gain on that asset. Canstar has an income tax calculator that can assist you to calculate your approximate income tax for the current financial year.

Source: atotaxrates.info

Source: atotaxrates.info

Original Price x 11 GST-Inclusive Price. It can be used for the 201314 to 202021 income. Instantly work out your estimated tax return refund. How to Calculate Income Tax in Australia 1. CALCULATE YOUR REFUND NOW.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title how to calculate tax australia by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.